Overview[]

Also called "Inhabitant Tax" or 住民税 (じゅうみんぜい, juuminzei), Residence Taxes are deducted every June for people living in Japan, regardless of the length of their residency.

Residence tax in Tokyo is made up of both "Ward Tax" 特別区民税 (とくべつくみんぜい, tokubetsu kuminzei) and "City Tax" 都民税 (とみんぜい, tominzei) but the distinction is largely unnecessary for our purposes as you will pay both.

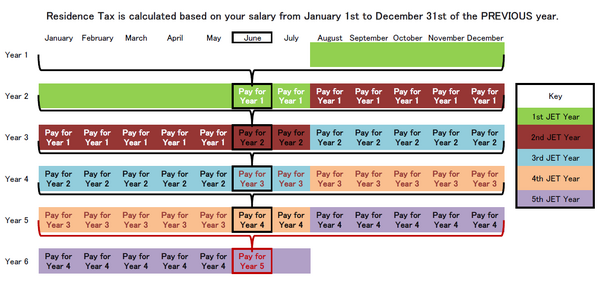

This tax is 10% of your taxable income earned in Japan during the previous calendar year from January 1st until December 31st and is applied in June of the current year. That is, you will pay monthly starting in June for taxes calculated based on the previous year's salary. If you leave Japan, you will be required to pay the rest as a lump sum. If you leave Japan on or after January 1st, you will be expected to pay residence tax on the previous year. (See Leaving JET below.)

How to Pay[]

You will pay your Residence Taxes in one of two ways:

- Either: Your Contracting Organization will automatically deduct your residence tax from your salary beginning in June until the following May.

- Or: You will receive a series of bills in the mail. Bills will arrive in June, August, October and January and can be paid like any other bill at a convenience store.

How to Calculate[]

Don't be taken by surprise by your tax amount. You can calculate an estimate based specifically on JET salaries using the following calculator. (Note: Google Docs may be blocked on public school laptops.)

In general, you may expect to pay approximately the following amounts. (Note: These amounts are rounded.) [link to source]

| Taxes Due | Total | Monthly | Total w/ 2yr Exemption |

|---|---|---|---|

| At the end of your 1st JET Contract | ¥42,000 | ¥3,500 | ¥0 |

| At the end of your 2nd JET Contract | ¥140,000 | ¥11,600 | ¥0 |

| At the end of your 3rd JET Contract | ¥160,000 | ¥13,000 | ¥47,000 |

| At the end of your 4th JET Contract | ¥170,000 | ¥14,000 | ¥170,000 |

| At the end of your 5th JET Contract | ¥175,000 | ¥14,600 | ¥175,000 |

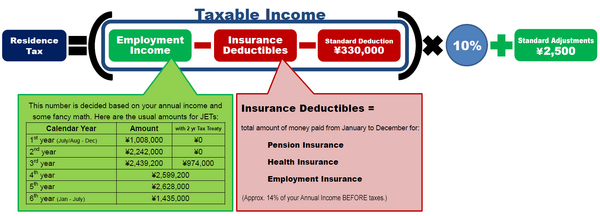

Simply put, Residence Tax = Taxable Income * 10% + ¥2,500

- Taxable Income = Employment Income - Total fixed-rate exemptions (i.e. Insurance Payments) - ¥330,000

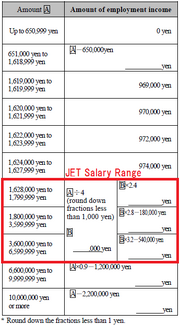

- Employment Income = Annual Income (7 months of one JET salary plus 5 months of your JET salary after your yearly raise) input into the table below: (Your salary amount should fall within the highlighted section unless you qualify for Tax Exemptions.)

- Tax Exemptions = If you qualify for tax exemptions, subtract the tax exempt amount from your Annual Income before applying the math from the table. For example, a third year JET whose salary had been tax exempt until July should calculate: ¥3,725,000 (Jan-Dec salary) subtract ¥2,100,000 (Jan-July salary) = ¥1,625,000

- Total Fixed-Rate Exemptions = the total amount that was withdrawn from your paycheck monthly for Pension Insurance, Health Insurance, and Employment Insurance. This number can also be found on your "Income Tax Withholding Statement" which is given to you in January by your contracting organization. It can also be estimated by multiplying your Annual Income by 14% (9% for Pension Insurance, 5% for Health Insurance, .3% for Employment Insurance)

- Standard Deduction = A flat ¥330,000 deduction that all tax payers are entitled to.

- Tax Rate = Residence Tax is comprised of two tax rates; the "Special Ward Tax" rate is 6%, and the "City Tax" rate is 4%. To simplify the calculation, you can simply multiply by 10%.

- Standard Adjustments = Both the Special Ward Tax and the City Tax have standard adjustments for deductions and equalizations. Simplified, they amount to an additional ¥2,500 in taxes that you owe.

Residence Tax Notification[]

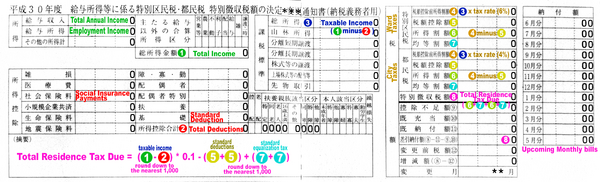

Every May you should receive a notification of the Residence Tax that will be due that June from your school. (JETs who are tax exempt for two years will not receive this until their third year.) It will be a small, three-fold slip of paper printed in red or blue ink and look similar to the above image. This is the "給与所得等に係る特別区民税・都民税 特別徴収税額通知書" kyuuyo shotoku nadoni kakawaru tokubetsu kuminzei / tominzei tokubetsu choushuu zeigaku tsuuchisho (Notification of Special Tax Collection of Ward and City Taxes Based on Annual Salary) at the top.

You should consider checking the figures on your notification against those of your Income Tax Witholding Statement and payslips from the previous year. Beyond that, there is nothing else to be done with this paper except to keep in for your records.

Leaving JET[]

If you leave Japan in July/August, as a non-recontracting JET you are not exempt from taxation for the previous year. At the time of departure, you will be required to pay the remainder of the residence tax in one lump-sum payment (jūminzei ikkatsu chōshū 住民税一括徴収).

For example, in this figure the JET leaving at the end of their 5th JET year will have to pay the lump-sum payment calculated from their 5th calendar year.

This will either be automatically deducted from your salary or you will be asked to pay via a bill or tax representative. Please consult with your school to confirm which method you will be asked to use. You may be able to pay the lump-sum at your local city office or tax office before leaving without having to appoint a tax representative.

If you leave Japan before June, your residence for the previous year will not have been calculated yet. You may appoint a tax representative who will help you to pay your taxes after they have been calculated, or you may be able to visit your local city office or tax office to get it calculated and pay the lump-sum.

If you stay in Japan after JET, you will have to continue paying your residence tax. Please update your address by submitting a moving-out notice (tenshutsu todoke 転出届) to your current municipal office and submitting a moving-in notice (tennyuu todoke 転入届) to the municipal office of wherever you move to. Currently, your residence tax is automatically deducted (this method is called tokubetsu choushuu 特別徴収). If you stay in Japan, you will be sent a monthly residence tax bill to your new address (this method is called futsuu choushuu 普通徴収). You should talk to your new employer whether they will automatically deduct residence tax for you or if you will continue to pay via monthly bills.

Tax Exemptions[]

First and second year JETs from the following nationalities may be exempt from taxes due to a tax treaty their home country holds with Japan:

- China (up to three years)

- Ireland

United States(*see note)- Korea

- Germany

- Philippines

- France

JETs from the UK, Australia, Canada, Jamaica, Singapore, Trinidad and Tobago, New Zealand, Barbados, and South Africa are not eligible for tax exemption. You can find more information about the tax situation in your home country on the Ishikawa JET Wiki.

In order to qualify for Tax Treaty Exemption, you will need to file the Income Tax Convention Form and proof of Tax Residency in your home country such as the IRS Form 6166 which American JETs were told to bring with them.

NOTE: The U.S.-Japan Tax Treaty was revised and ALTs are no longer eligible for the tax exemption. Specifically, ALTs that arrived Japan by 30 August 2019 are eligible for the tax exemption. ALTs that arrived Japan on or after 31 August 2019 are NOT eligible for the tax exemption.

Common Issues[]

Employers in Japan are responsible for the vast majority of the tax calculation and filing for citizens. As such, it is not uncommon for there to be some mistakes. Some of the most common errors for Tokyo JETs are as follows.

| |

|---|---|

| What it looks like | You are paying Income Tax and Residence Tax although you have a 2-3 year exemption. |

| Cause | If you do not file the necessary paperwork for your tax treaty immediately upon arrival, you may find that you are taxed according to the standard rate. Private school JETs in particular seem to have this problem as schools often do not know to ask for your paperwork. |

| Solution | Contact your supervisor and office staff. JETs with this problem have been able to file their tax treaties late and be refunded the full amount paid. You will need to apply for the refund by filling out the application with your school, who will then file it for you. |

| |

| What it looks like | You receive a "Special Wards Resident Tax Declaration Form (特別区民税申告書)" from your ward office in the mail in Feb/March. |

| Cause | As far as I can tell, this form is automatically sent out to 3rd year JETs who have not paid taxes up until this year due to tax treaties. |

| Solution | Take the form in to your school's office to confirm with them about how your residence taxes are handled. It will likely be unnecessary for JETs to fill out and turn in this form by March 15th. This because, as a salaried employee, your school should be filing taxes for you and automatically deducting the required amount from your pay check monthly. However, this may be different for some private school JETs. Regardless of your situation, you should confer with your supervisor and school records office. |

Useful Vocabulary[]

| English | Japanese | Pronunciation |

|---|---|---|

| Income Tax Withholding Statement | 給与所得源泉徴収票 | kyuyo-shotoku-gensen-choshu-hyo |

| Residence Tax | 住民税 | jumin-zei |

| Residence Tax (Prefectural) | 県民税 | kenmin-zei

|

| Residence Tax (Municipal) | 市民税 | shimin-zei

|

| Total Annual Income | 給与収入 | kyuyo-shunyu

|

| Employment Income Deduction | 給与所得控除 | kyuyo-shotoku-kojo

|

| Total fixed-rate exemptions | 所得控除 | shotoku-kojo

|

| Income after employment income deduction | 給与所得 | kyuyo shotoku

|

| Total Taxable income | 課税所得 | kazei-shotoku

|

| Notice of Residence Tax Lump Sum Payment | 住民税一括徴収申請書 | jūminzei ikkatsu chōshū shinsei-sho |

See Also[]

- Taxes Category

- Income Tax

- Residence Tax

- Spring Tax Deduction

- Pension Refund (Public)

- Pension Refund (Private)

Sources[]

- Tokyo Bureau of Taxation Website

- Shibuya's "Inhabitant Tax of The 23 Special Cities in Tokyo" Guide

- Nagoya International Center Website